This is an excerpt from a Market Intel article by America Farm Bureau Federation

A lot happens between when a crop is harvested or a cow is milked and when a consumer sits down for breakfast. Generational trends influence how and where people enjoy eating and the convenience of accessing and transporting food shifts how farmers and ranchers market their goods and build relationships with processing facilities and retail outlets. Market-moving events, like COVID-19 or rising inflation, disrupt these trends and have often exposed new or unexpected avenues for consumption.

Food at Home

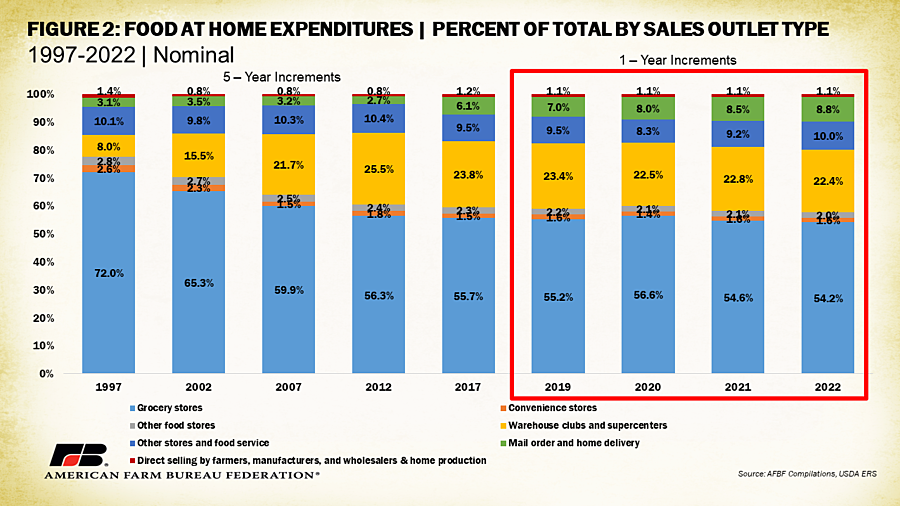

For food consumed at home, grocery stores have consistently captured the largest market share, though this share has decreased significantly. In 1997, grocery stores accounted for 72% of food at home expenditures. This dropped to 65% five years later in 2002 and to under 60% in 2007. In 2022, grocery stores took up 54.2% of at home food spending. The only time grocery stores’ market share has increased since 1997 is between 2019 and 2020, a likely result of people returning to grocery outlets amid lockdowns.

Much of the decline in grocery store market share for at home spending has been the growth of warehouse clubs and supercenters and home delivery. Including popular bulk shopping centers like Costco and Sam’s Club, this category increased its market share from 8% in 1997 to 25.5% in 2012. Consumers have been attracted by the cost savings of buying in bulk, especially those supporting larger families, contributing to the growth of the warehouse segment.

Bulk shopping centers’ over-a-quarter-of-the-market capture was then reduced by the entry of popular home delivery options between 2012 and 2017. In 2012, home delivery spending made up only 2.7% of at home food spending; by 2017 that share had risen to 6.1%.

In 2022 warehouses and supercenters claimed 22.4% of food at home expenditures and mail order and home delivery claimed 8.8%. Interestingly, the value of food at home purchased directly from farmers, manufacturers and wholesalers and through home production has hovered between 0.8% and 1.4% with little visible trend.

These trends are further revealed in dollar value increases. Between 1997 and 2022 food expenditures at grocery stores increased from $270 billion to $567 billion, a 109% increase. During the same period, spending at warehouse clubs and supercenters grew from $30 billion to $234 billion, a 679% increase. Similarly, spending on food delivery increased 684% from $11 billion in 1997 to $91 billion in 2022.

In a consumer environment where convenience is king, it is likely delivery food expenditures will only increase, though a recessionary period could drive a return to money-saving options. Other innovative at home food options could alter these trends.